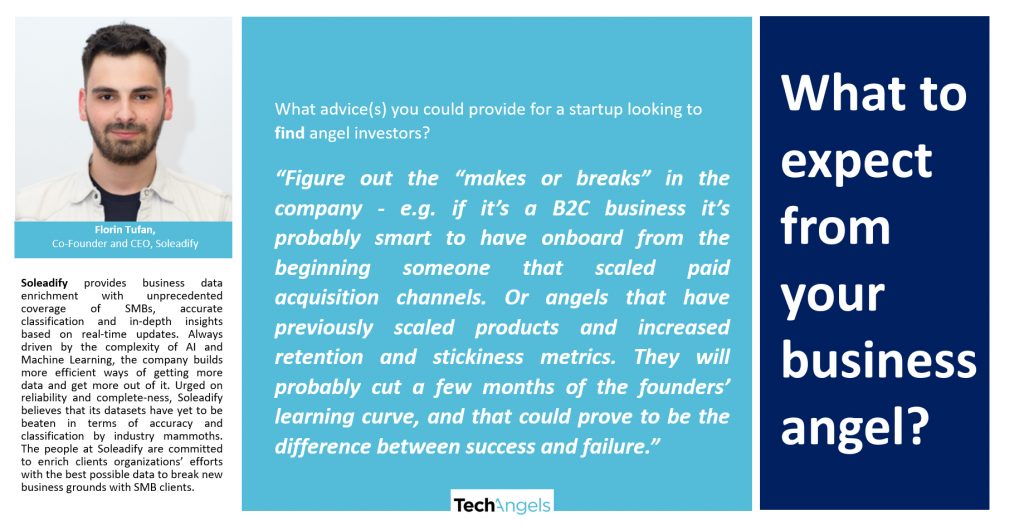

Florin Tufan, Co-founder and CEO of Soleadify

During what phase of your startup development have you started to work with angel investors?

We started working with angel investors right from the start. We started Soleadify with an angel investment of €50.000 from Matei Pavel which, along with the founders’ own money, allowed us to pay for the initial product development.

Did you choose your angel investors? What were the thinking and criteria behind?

Of course! At pre-seed we chose to raise from an experienced serial entrepreneur with several exits, who mentored us throughout our next steps. At seed, we raised from several angel investors that had expertise and years (sometimes decades) of experience. We looked specifically for angel investors that can complement us in the many challenges to come, with backgrounds in the areas where we lacked experience.

Did you choose to work with one or with more angel investors?

Several. Building a startup is one of the most challenging endeavors one can go through – and any help you can get will be more than welcome at the right time. We believe that support from experienced entrepreneurs and tech people makes a “life or death” type of difference in critical moments.

Looking retrospectively how was your cooperation with the angel investor(s)?

We keep in touch throughout our journey, and reach out with specific challenges to people that have mastered them before. To us founders, angels help significantly with the speed of learning and the quality of our decisions.

How did the angel investors contribute?

We’ve made our most critical decisions in the business so far with the help and guidance of our investors. This spans from a major pivot to important hiring decisions, and we don’t expect this to change in the future.

In what areas was the cooperation the most useful?

We made a major pivot 9 months ago, after which we decided to target enterprise customers. Us founders have no prior experience in working with large corporations, but despite that the business is growing quickly. I think a major factor in our recent success is the cooperation with our investors.

In what areas you couldn’t get specific help from your angel investors?

Market-specific questions. We couldn’t find local angels with experience in our specific market, but plan on adding a US-based angel investor with experience in our market, at our series A.

If it would be to start all over in this relationship, would you do the same? What would you change?

I would be much clearer in our communication (regular cadence, regular structure etc). And also, with setting very clear expectations.

Would you say that the angel investors supported you in a significant way, or it was difficult to gain access to them as a resource?

They helped to a “make or break” extent.

Do you have now a preferred way to work with an angel investor?

I think we still don’t do a good job when it comes to our communication, as most of it still happens quite ad-hoc.

What advice(s) you could provide for a startup looking to find angel investors?

Figure out the “make or breaks” in the company – e.g. if it’s a B2C business it’s probably smart to have onboard from the beginning someone that scaled paid acquisition channels. Or angels that have previously scaled products and increased retention and stickiness metrics. They will probably cut a few months of the founders’ learning curve, and that could prove to be the difference between success and failure.

Also, something that I think is generally underestimated, is having people in your network with a previous exit experience, that can help you “make it happen” when the right time comes.

Once they identified the investors, what would your advice be for your fellow founders to engage with angel investors?

- Be very prepared, train before. You should think in advance of the questions you’re going to receive. The person in front of you will come with questions on the spot, and if they can think on the spot of a problem, you haven’t foreseen, I’d say that should be a very bad sign. The expectation is that you’re the expert in whatever your startup does, and I think it’s a fair expectation.

- Be fully honest – if they say “yes” to you, it’s the beginning of a long-term relationship, with years of communication in front of you. This relationship should start on the right foot.

- Set very clear expectations – ask for what you want, and communicate where you expect the angel to help you. Validate with the angel that they can actually help where you expect them to. If you can’t, you’re probably not speaking to the right person for your company.

About

Soleadify provides business data enrichment with unprecedented coverage of SMBs, accurate classification and in-depth insights based on real-time updates. Always driven by the complexity of AI and Machine Learning, the company builds more efficient ways of getting more data and get more out of it. Urged on reliability and complete-ness, Soleadify believes that its datasets have yet to be beaten in terms of accuracy and classification by industry mammoths. The people at Soleadify are committed to enrich clients’ organizations efforts with the best possible data to break new business grounds with SMB clients.