Bucharest, November 11, 2020 – One third of the European start-ups are facing risks from the economic impact of the pandemic, according to a survey by europeanstartups.co (a monitoring platform supported by the European Commission and initiated by dealroom.co and sifted.com). By creating new jobs, with an annual growth of more than 10%, start-ups have been the most active growth driver across Europe in the last 4 years.

Continuing to support the start-up ecosystem, particularly tech start-ups, is a priority strategic direction of major importance for the entire European continent, especially since, even without the pandemic, Europeans are lagging behind the American and Asian markets. In Romania, the community of tech-focused investors and start-ups has continued to progress at a sustained pace, although assessments are yet to be made regarding the total investments made this year, which has seen changes and many uncertainties.

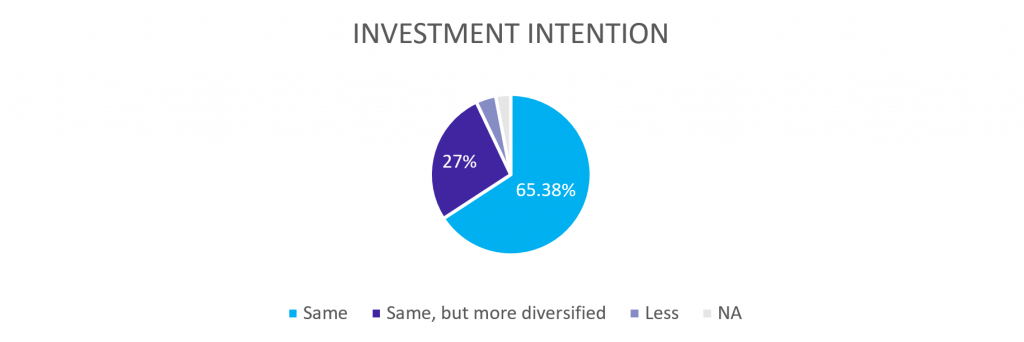

TechAngels conducted a survey among its members – 70 entrepreneurs and corporation professionals – assessing the investment intentions of the business angel community interested in the technology sector. 92% of the TechAngels members are determined to maintain their level of investments in tech start-ups, while 27% will also choose to diversify their interests through the various investment or venture-capital platforms.

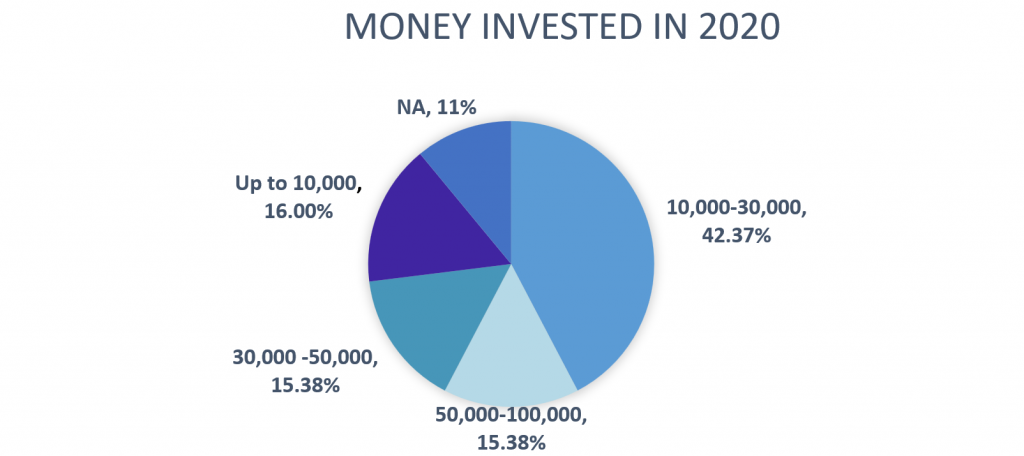

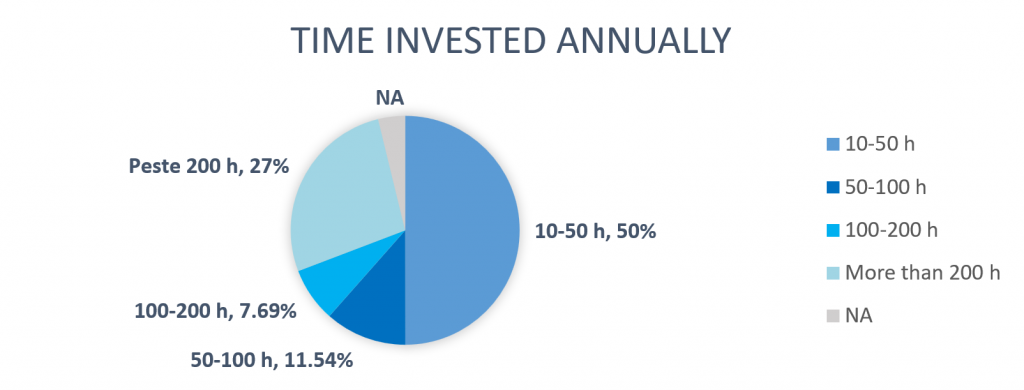

The greatest percentage of the TechAngels, 42.37%, invested tickets ranging from EUR 10,000 to EUR 30,000 in 2020, while the organization contributes an average of 1,100 hours of consultancy, coaching and mentorship every year. The mentorship and coaching component, which requires experience transfer from angel investors to the young start-up founders, is probably more important than the actual seeding money invested, because an experienced TechAngel can help the founders avoid mistakes, define better strategies and support strategy execution. This can be worth tens of thousands of euro for the start-ups in that phase of development and can make the difference between success and failure, given that many start-ups have limited money available at these phases.

Overall, the investments made in 2020 can be assessed to be similar to the EUR 6 mln. level in 2019, although the number of tickets ranging from EUR 10,000 to EUR 30,000 increased to the detriment of greater EUR 30,000 to EUR 50,000 tickets, which indicates more start-ups and more diversified investment portfolios, therefore better control of investment risks.

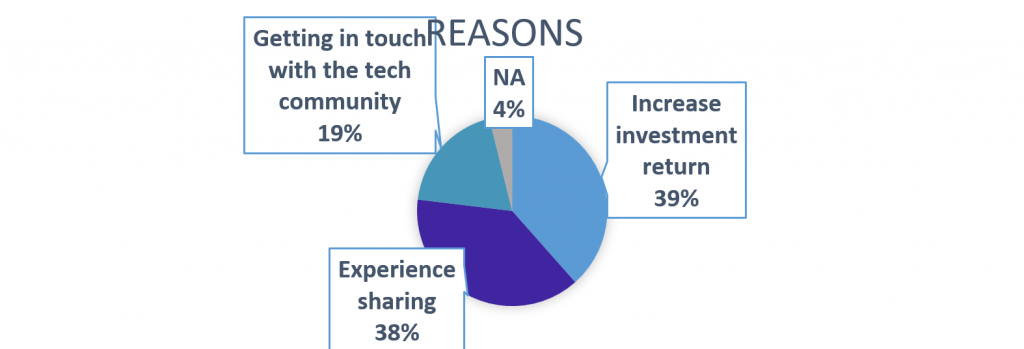

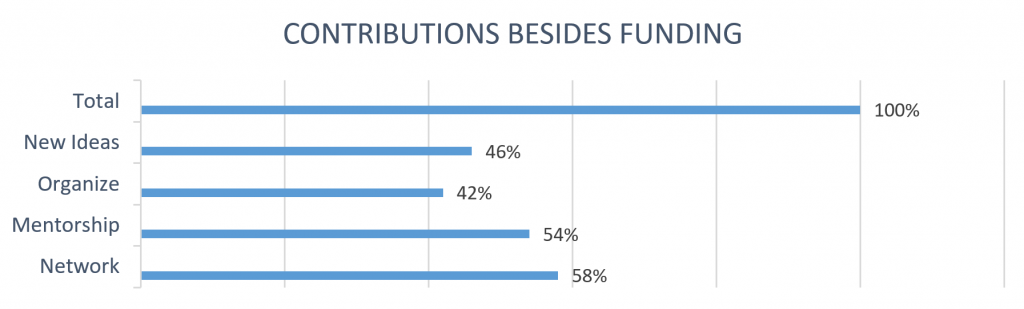

In fact, angel investors sharing their business experience is equally important (38% of the respondents) to investment return (39%) among the top reasons for TechAngels members to participate in strengthening the entrepreneur and investor community. The contribution of business angels is most frequently represented by network access (58%), mentorship (54%), new ideas (46%).

“The most dynamic segment of the economy is also the most vulnerable one currently. At first glance, start-ups appear not to pose a major issue, as these are small companies. However, the thing that may be lost – and sometimes irreversibly – is the potential driven by start-ups in their markets. It takes a strong ecosystem to nurture a start-up, just as they say that it takes a village to raise a child. We have realized this need and we have stepped up our contacts with start-ups and other members of the community – accelerators, VC funds, etc. – and we intend to involve new partners,” says Malin Iulian Stefanescu, President, TechAngels.

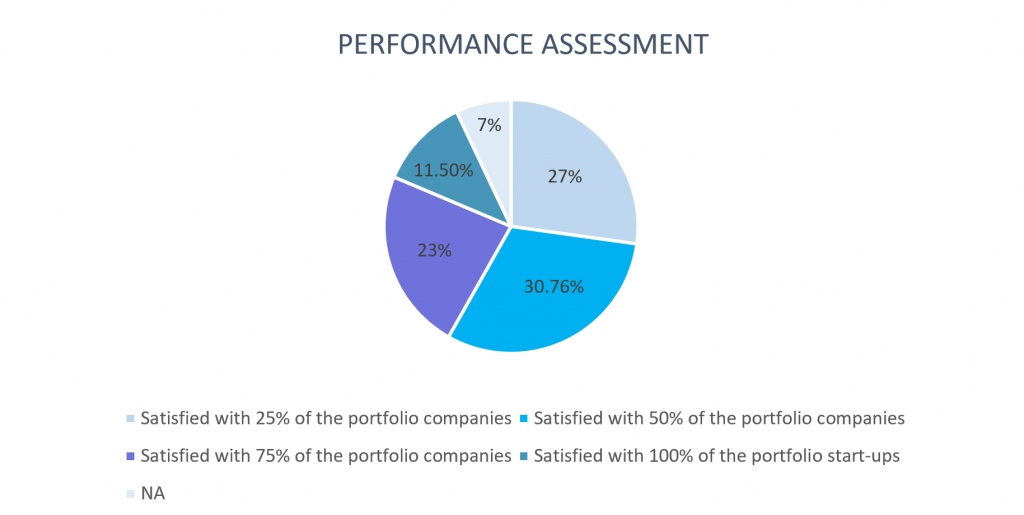

The way in which start-ups have evolved is deemed by the TechAngels investors as mostly satisfactory – 50% of the investors are pleased with the performance of more than 50% of the companies in which they invested.

Besides the issue of funding, which is lower locally compared to European hubs, start-ups also need support in the development of their own plans and competence to avoid additional risks other than those already known and common to start-ups.

According to the TechAngels survey, approximately 50% of the encountered start-ups focus excessively on the product, while disregarding market and business matters, while approximately 35% overvalue their solution. 50% of the TechAngels investors flagged the lack of focus, while more than one third also added lack of confidence in the previous experiences.

“We are looking forward to start-up founders approaching us without hesitation, as we have created an easy-to-access and easy-to-use system to meet for pitches. We will help them with feedback during or after the pitching sessions, we will try to share with them our experience in developing tech business, we will guide them towards the best acceleration methods, and the individual members of our association who wish to invest will be able to contact them directly or through investment funds,” underlines Mihai Guran, Vice President, TechAngels.

The TechAngels portfolio currently consists of 115 companies, with more than EUR 11 million invested by the group over the last 3 years in technology start-ups addressing issues in various areas – healthcare, education, logistics, finance, gaming, marketplace, etc.

The TechAngels investors make their investment decisions individually or collectively following the pitch sessions held each week or by attending industry events. In the first three quarters of this year, the TechAngels have met with more than 200 start-ups.