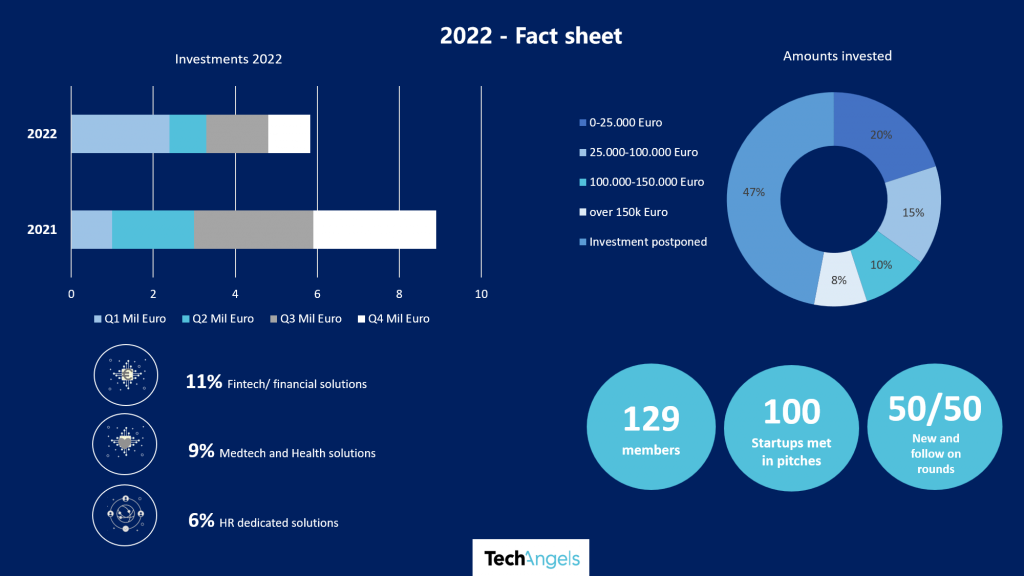

- Total annual investments were 36% less than in 2021, the all-time-high year

- Investments were 41% higher than in 2020, in line with the pre-pandemic levels

- EUR 1.023 million investments in Q4 2022, a modest quarter vs. the start of the year, which confirmed the impact of the war in Ukraine on the market

- There were pitch meetings with 100 startups out of a total 150 startups assessed, with 17 of those receiving funding

- Investors mostly opted for 50% follow-on rounds and 50% initial funding rounds

- 53% of the group’s member investors were active, while 48% postponed new investments in 2022

Bucharest, 14 February 2023 – Aggregate investments made by the members of TechAngels, the largest network of angel investors in Romania, in 2022 amounted to EUR 5.679 million, with EUR 1.023 million placed in the last quarter of the year. This amount meant a 36% decrease vs. the all-time-high year of 2021, when investments neared EUR 9 million, but also a 41% increase compared to 2020.

“An analysis of data for the entire year confirms the impact of the war in Ukraine on the general attitude on the market. The first quarter showed signs of another record year, with more than EUR 2.5 million invested, but, unfortunately, uncertainties and economic pressures following the outbreak of the armed conflict led to a slowdown in the pace of investments. It is also worth noting that the impact of the pandemic continues to be felt. One of the possible explanations for the small number of new solutions worth considering investing might be, among others, the fact that, during the pandemic, some teams were deterred or could no longer develop as they wanted to,” says Malin-Iulian Stefanescu, President, TechAngels.

In 2022, 20% of all TechAngels members invested up to EUR 25,000, 15% invested between EUR 25,000 and EUR 100,000, 10% between EUR 100,000 and EUR 150,000, and 8% more than EUR 150,000, while the rest chose not to invest last year.

Throughout the year, the 129 TechAngels assessed more than 150 startups, had pitch meetings with 100 startups and chose to invest in 17 of those. The investments were placed either directly or through investment funds or platforms.

Overall, TechAngels contributed more than EUR 35 million to the development of the local tech ecosystem from 2017 to 2022.

TechAngels’ activity in 2022 also included sessions dedicated to Ukrainian startups and pitches at European level with Business Angels Europe, one of the European networks where TechAngels is a member.

“As regards pitched solutions by industries, finance solutions ranked first in 2022, from neobanks to finance management solutions (approximately 11%), followed by healthcare solutions (7%), with various platforms for medical assistance and appointments, specialized marketplaces and treatment solutions. HR solutions (6%) came in third, involving automation of recruitment, onboarding, training, loyalty processes,” added Malin Stefanescu.

It is hard to classify the types of pitched solutions under any one single category, as there were mixed B2B and B2C solutions, as well as solutions that also integrated specialized hardware or addressed needs horizontally for multiple industries or operations. Besides those, there were also solutions targeting the general public, in areas such as active life/sports, home and family management assistance, entertainment/music, ticketing, video, etc.

In 2023, some 50% of the TechAngels members said they will maintain their investment strategy focusing on supporting startups where they have already investment, as well as new startups with a stable viable product and minimum confirmation/traction on the market.

In terms of advice believed by the members of the community to be important for startups and investors, the main idea put forward by an internal survey conducted among TechAngels members was that startups should be brave enough to generate new solutions and avoid meme-type solutions. As for investors, the recommendation was that they should do a thorough due diligence and not “sit on the cash and do nothing,” meaning that they should be more open to new ideas.

TechAngels members supported projects to accelerate and develop the local tech ecosystem as mentors and jurors in events such as How To Web, Techcelerator, Commons Accel, Next FinTech, StepFWD, Endeavor, RubikHub, Launch, where they met with another 60 startups. TechAngels members were also involved in community growth projects internationally, such as BigAngels Days or the EBAN and BAE events.